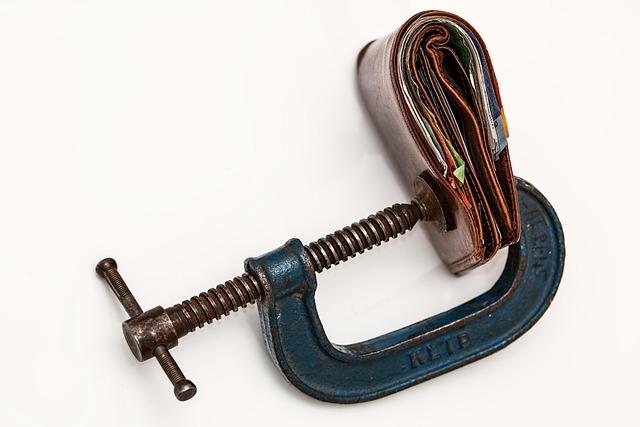

In today's challenging economic climate, rising costs and unpredictable employment strain personal finances. Traditional loan services often fall short due to strict eligibility and high-interest rates. This has fueled demand for accessible Loan For Debt Consolidation, which combines multiple debts into one manageable Debt Consolidation Loans. These loans offer lower interest rates, simplified repayment, and financial stability, helping individuals overcome complex debt situations and gain control over their finances. By consolidating high-interest debts, borrowers can free up budget resources for other financial goals, ultimately achieving better credit scores and improved financial flexibility.

In today’s economic climate, understanding the importance of affordable loan options is paramount. With interest rates at an all-time high, managing personal debts has become a significant challenge for many. This article explores the growing need for accessible financial solutions, particularly Debt Consolidation Loans, which offer a strategic path to financial freedom. We delve into how these loans can simplify multiple debt management, providing much-needed relief and control over one’s finances. By examining various loan for debt consolidation options available today, readers will gain valuable insights into securing the best solution for their unique circumstances.

- Understanding the Current Financial Landscape: A Growing Need for Affordable Loans

- The Impact of High-Interest Rates on Personal Finances

- Debt Consolidation Loans: Unlocking Financial Freedom and Management

- Benefits of Loan Consolidation for Managing Multiple Debts

- Exploring Different Types of Affordable Loan Options Available Today

- Taking Control: Strategies for Securing the Best Loan For Debt Consolidation

Understanding the Current Financial Landscape: A Growing Need for Affordable Loans

In today’s economic climate, many individuals and families are navigating a complex financial landscape. The rising cost of living, coupled with unpredictable job markets, has led to an increased demand for accessible and affordable loan options. As a result, there is a growing need for solutions that cater to those seeking debt consolidation loans—a strategy to simplify and reduce the burden of multiple debts by combining them into one manageable loan.

This shift in financial dynamics is particularly evident among younger generations entering the workforce and older adults facing unexpected expenses. Traditional loan services may not always meet these needs, especially with stringent eligibility criteria and high-interest rates. Thus, affordable loan options have become a vital lifeline, offering a chance at financial stability and freedom through debt consolidation loans.

The Impact of High-Interest Rates on Personal Finances

In today’s economic climate, with rising costs and inflation, high-interest rates are putting a strain on many individuals’ personal finances. When interest rates are high, borrowing money becomes more expensive, impacting those who rely on loans for various purposes. This is particularly relevant when discussing debt consolidation loans—a popular strategy to manage multiple debts by combining them into one loan with potentially lower interest rates. By securing a loan for debt consolidation at competitive rates, individuals can reduce their overall monthly payments and the stress associated with managing multiple lenders.

High-interest rates can exacerbate existing financial challenges, especially for those burdened with credit card debt or personal loans. The increase in borrowing costs means that every dollar spent on interest represents a direct reduction in disposable income. This can hinder savings goals, make budgeting more difficult, and even push individuals into further debt. As such, affordable loan options are now more crucial than ever to provide relief and enable people to gain control over their financial situations through strategic debt consolidation.

Debt Consolidation Loans: Unlocking Financial Freedom and Management

Debt Consolidation Loans offer a strategic approach for individuals and families to gain control over their finances. In today’s economic climate, many people find themselves burdened by multiple debts, from credit cards to personal loans. This can create a complex web of payments, often with varying interest rates, leaving individuals feeling trapped and overwhelmed. A Loan For Debt Consolidation provides a solution by combining these outstanding debts into a single, more manageable loan.

By consolidating debt, borrowers can simplify their financial obligations, making it easier to stay on top of repayments. This method also often results in lower monthly payments, thanks to the potential for extended repayment terms and lower interest rates compared to individual debt. Financial freedom becomes achievable as individuals can allocate funds previously dedicated to multiple debts towards other priorities or savings goals.

Benefits of Loan Consolidation for Managing Multiple Debts

Having multiple debts can be a complex and overwhelming situation, with various loan terms, interest rates, and repayment schedules to keep track of. This is where Loan Consolidation comes in as a powerful tool for financial management. By taking out a single Loan For Debt Consolidation, borrowers can combine all their existing debts into one manageable payment. This simple yet effective strategy offers numerous benefits, including reduced stress and improved cash flow. With consolidated loans, individuals can bid farewell to the hassle of multiple monthly payments, making it easier to stay on top of their financial obligations.

Moreover, debt consolidation loans often come with lower interest rates compared to individual debts, saving borrowers significant amounts over time. This is particularly advantageous for those burdened by high-interest credit card debts or personal loans. By consolidating these debts, individuals can free up money in their budget, allowing them to allocate resources towards other important financial goals, such as building an emergency fund or investing for the future.

Exploring Different Types of Affordable Loan Options Available Today

In today’s financial landscape, exploring affordable loan options has become increasingly vital for managing personal finances effectively. One prominent option gaining traction is debt consolidation loans, designed to simplify complex financial situations. These loans allow individuals to combine multiple high-interest debts into a single, more manageable payment. By doing so, borrowers can reduce their overall interest expenses and alleviate the stress of juggling various repayment schedules.

Debt consolidation loans are particularly appealing for those burdened by credit card debt or other unsecured loans. A loan for debt consolidation offers a straightforward path to financial sanity, enabling borrowers to focus on making consistent payments towards a single, consolidated debt. This strategic approach not only simplifies financial management but also paves the way for improved credit scores over time, providing a fresh start and enhanced financial flexibility in the future.

Taking Control: Strategies for Securing the Best Loan For Debt Consolidation

Taking control of your finances is an empowering step, and one effective strategy is to consider a Loan for Debt Consolidation. In today’s financial landscape, many individuals are burdened with multiple debts, each carrying its own interest rates and repayment terms. This can create a complex web of payments, making it challenging to manage and potentially leading to higher overall debt. A strategic approach to debt consolidation can simplify this situation significantly.

By opting for a Debt Consolidation Loan, you have the opportunity to combine these debts into a single, more manageable loan with a potentially lower interest rate. This simplifies repayment by reducing the number of payments you need to make each month. Furthermore, it allows you to focus on paying off the principal amount rather than just the interest, which can lead to long-term savings. It’s an efficient way to gain financial clarity and take charge of your monetary future.

In today’s financial landscape, where high-interest rates are a growing concern, understanding the benefits of affordable loan options is crucial. Debt consolidation loans emerge as a powerful tool to manage multiple debts and regain financial freedom. By exploring various types of affordable loan choices available, individuals can take control of their finances, consolidate debts, and make informed decisions for a brighter financial future. Securing the right Loan For Debt Consolidation can significantly impact one’s overall monetary well-being, making it a strategic step towards financial stability.