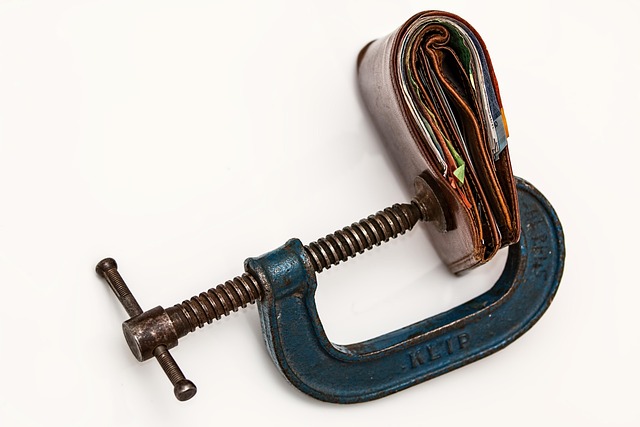

Debt Consolidation Loans (no-fee loans) offer a streamlined way to manage multiple debts by combining them into one loan with flexible terms and no extra fees. This approach, ideal for credit card debt or personal loans, simplifies repayment, reduces interest costs, improves cash flow, and can help individuals pay off their debts faster. By consolidating debts, borrowers escape high-interest payments and various fees, aligning repayment schedules with individual income patterns for better financial planning.

Are you burdened by multiple debts with high-interest rates? Consider no-fee loans as a solution to simplify your finances. This article explores the benefits of Debt Consolidation Loans without hidden fees, explaining how they work and their positive impact on financial health. We’ll guide you through no-fee loan options, empowering you to make informed choices for debt relief and long-term financial stability. Discover how a loan for debt consolidation can be your path to financial freedom.

- Understanding No-Fee Loans and Their Benefits

- How No-Fee Debt Consolidation Loans Work

- Navigating No-Fee Loan Options for Better Financial Health

Understanding No-Fee Loans and Their Benefits

No-fee loans are a financial solution designed to simplify and ease your monetary burden by eliminating certain fees associated with traditional loan products. These loans, often referred to as Debt Consolidation Loans or Loan For Debt Consolidation, offer a straightforward approach to managing multiple debts. By consolidating various loans into one with no additional charges, individuals can streamline their repayment process, making it more manageable and potentially reducing overall interest paid.

This type of loan is particularly beneficial for those dealing with credit card debt, personal loans, or other unsecured debts. It provides an opportunity to combine these obligations into a single payment, simplifying budgeting and potentially lowering monthly expenses. No-fee loans can also offer flexible repayment terms, allowing borrowers to tailor their payments to fit their income and financial goals, thereby fostering better financial control and stability.

How No-Fee Debt Consolidation Loans Work

No-fee debt consolidation loans offer a straightforward and cost-effective solution for managing multiple debts. Instead of juggling various loan payments, this type of loan allows borrowers to combine all their existing debts into one single loan with a single payment. The process starts by applying for a loan for debt consolidation, where lenders assess your financial situation and creditworthiness. Upon approval, the lender provides you with a lump sum to pay off all your outstanding debts, eliminating the need for multiple payments.

With a no-fee debt consolidation loan, borrowers benefit from reduced administrative costs and potential savings on interest rates compared to maintaining several high-interest loans. This approach can simplify financial management, improve cash flow, and help individuals get out of debt faster by consolidating their repayments into one manageable payment.

Navigating No-Fee Loan Options for Better Financial Health

Navigating no-fee loan options can be a game-changer for managing your finances and achieving better financial health. These loans, as the name suggests, come without any hidden fees or charges, making them an attractive proposition for borrowers looking to simplify their financial obligations. One of the most popular uses for these types of loans is debt consolidation. A Loan for Debt Consolidation allows you to combine multiple high-interest debts into a single loan with a lower interest rate, effectively simplifying your repayment process and saving you money in the long run.

By opting for a no-fee debt consolidation loan, individuals can break free from the cycle of high-interest payments and various minimum fees associated with multiple credit lines. This strategy enables better financial planning as it centralizes repayments to one source, making it easier to manage your budget. Moreover, these loans often offer flexible terms, providing borrowers with the freedom to choose a repayment schedule that aligns with their income and expense patterns.

No-fee loans, particularly those designed for debt consolidation, offer a compelling solution for managing finances. By eliminating hidden fees and charges, these loans provide a clear path to financial health and stability. Whether considering a loan for debt consolidation or other purposes, understanding the benefits and available options can significantly impact your long-term financial well-being.