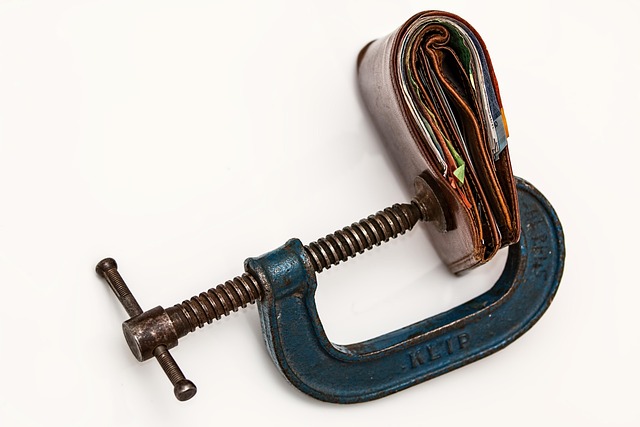

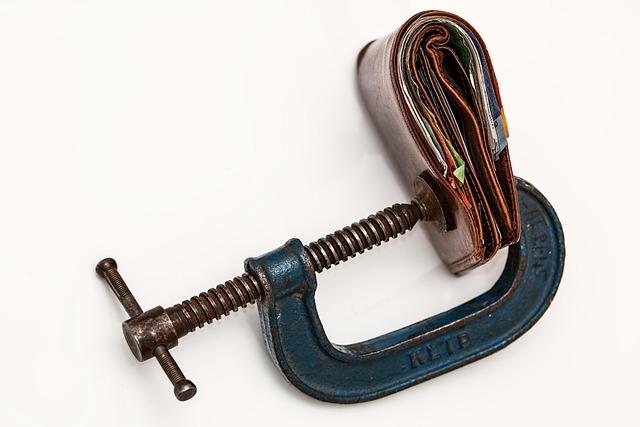

Debt Consolidation Loans streamline multiple high-interest debts into one loan with lower rates and simplified payments, freeing up cash flow, reducing stress from multiple due dates, minimizing interest expenses, and improving credit scores. These loans are accessible for borrowers with varying credit scores and offer long-term savings, shorter repayment periods, and relief from late fees and penalties. To apply, assess your financial situation, explore options, prepare documentation, submit an application, and review the loan offer carefully.

Looking to tame your debt with manageable monthly payments? This guide explores five affordable loan options for consolidation, empowering you to take control of your finances. We’ll demystify the process and walk you through choosing the best fit for your situation. From understanding the fundamentals of debt consolidation loans to debunking common myths, this comprehensive overview ensures you make an informed decision. Discover top choices and simplify your repayment journey today!

- Understanding Debt Consolidation Loans: A Comprehensive Overview

- Exploring Options for Low Monthly Payments

- Unlocking Affordable Debt Relief: Top Loan Choices

- Debunking Myths About Debt Consolidation Financing

- Step-by-Step Guide to Applying for a Loan With Easy Repayments

Understanding Debt Consolidation Loans: A Comprehensive Overview

Debt consolidation loans are a strategic financial tool designed to simplify and reduce the burden of multiple debts by combining them into one single loan with potentially lower interest rates and more manageable monthly payments. This type of loan allows borrowers to pay off various high-interest debts, such as credit card balances, personal loans, or even student loans, by providing a streamlined repayment plan. By consolidating debt, individuals can free up cash flow, avoid the stress of multiple payment due dates, and potentially shorten their overall repayment period.

A Loan for Debt Consolidation offers several benefits, including improved budget management, reduced interest expenses, and enhanced credit score over time. It works by taking out a new loan with a lower interest rate, which is then used to pay off existing debts. This process consolidates all debts into one, making it easier to manage payments and potentially save money in the long run. Additionally, debt consolidation can help individuals avoid late fees and penalties associated with multiple loans, providing them with a more stable financial foundation.

Exploring Options for Low Monthly Payments

When managing debt, one of the primary concerns is making payments that are both manageable and affordable. Exploring options for low monthly payments can significantly alleviate financial stress and provide a clearer path to repayment. Debt Consolidation Loans stand out as a popular choice among individuals seeking relief from multiple debt obligations. By consolidating various loans into one, these specialized financing options simplify repayment processes and often reduce overall interest rates, making them an attractive solution for those burdened by high monthly payments.

A Loan For Debt Consolidation can be particularly beneficial for individuals with credit card debts or multiple personal loans, as it allows them to refreeze their debt into a single loan with potentially lower monthly installments. This strategy not only simplifies budgeting but also reduces the overall interest paid over time, ultimately saving borrowers money and providing a more sustainable repayment plan.

Unlocking Affordable Debt Relief: Top Loan Choices

Debt can be a heavy burden, but there are options to lighten the load. Unlocking affordable debt relief is now easier than ever with various loan choices tailored to make repayment manageable. One popular and effective solution is Debt Consolidation Loans, designed to simplify multiple debts into a single, more accessible repayment stream. These loans often offer lower interest rates compared to credit cards, allowing borrowers to save on fees and better manage their finances.

A Loan For Debt Consolidation can be a game-changer for those overwhelmed by numerous debt payments. By consolidating, individuals can reduce the stress of multiple due dates and potentially shorten their overall loan term. This strategy not only simplifies budgeting but also empowers folks to regain control over their financial future. With careful consideration and the right lender, affordable monthly payments become achievable, paving the way for a brighter financial outlook.

Debunking Myths About Debt Consolidation Financing

Debt consolidation is often shrouded in myths and misconceptions, deterring many individuals from exploring it as a solution to manage their debt. One prevalent myth is that combining multiple debts into one loan will result in higher interest rates. However, this isn’t always true; when done right, a loan for debt consolidation can offer lower average interest rates compared to individual credit card balances. This is because the loan is typically secured, and consolidators can negotiate better terms with lenders.

Another misconception is that debt consolidation is only for those with excellent credit. While having good credit can make the process smoother, it’s not an absolute requirement. Many financial institutions cater to a wide range of credit scores, providing various debt consolidation loans tailored to different needs. These loans offer the chance to simplify payments and potentially reduce overall interest expenses, making it accessible for those looking to take control of their debt burden.

Step-by-Step Guide to Applying for a Loan With Easy Repayments

Applying for a loan with manageable monthly payments is a strategic move to tackle your debt, especially when considering a Loan For Debt Consolidation. Here’s a straightforward guide to help you navigate this process:

1. Assess Your Financial Situation: Begin by evaluating your current income, ongoing expenses, and the amount of debt you wish to consolidate. This step is crucial for determining your budget and choosing a loan suitable for your needs.

2. Explore Loan Options: Research and compare different lenders offering Debt Consolidation Loans. Look at various factors such as interest rates, repayment terms, and any associated fees. Online platforms can be a great resource for comparing multiple options side by side.

3. Prepare Your Documentation: Lenders will require specific documents to verify your identity and financial details. Gather essential papers like government-issued ID, proof of income (such as pay stubs or tax returns), and details of existing debts you wish to consolidate.

4. Submit an Application: Fill out the loan application form accurately and honestly. Provide all the requested information, including your employment history and debt details. Ensure you meet the basic eligibility criteria set by lenders, such as having a minimum credit score.

5. Wait for Approval and Review: After submitting your application, wait for the lender’s response. If approved, review the loan offer carefully, considering the interest rate, repayment schedule, and any additional terms. Understanding these factors is key to ensuring easy and affordable repayments.