Debt Consolidation Loans streamline repayment by combining multiple high-interest debts into a single loan with lower rates, reducing monthly payments, accelerating debt repayment, and freeing up financial resources. A Loan For Debt Consolidation offers strategic terms like fixed interest rates, providing protection against future rate changes. This consolidation breaks the cycle of compounding interest, enabling individuals to regain control over their finances, achieve long-term stability, and save money on interest charges over time.

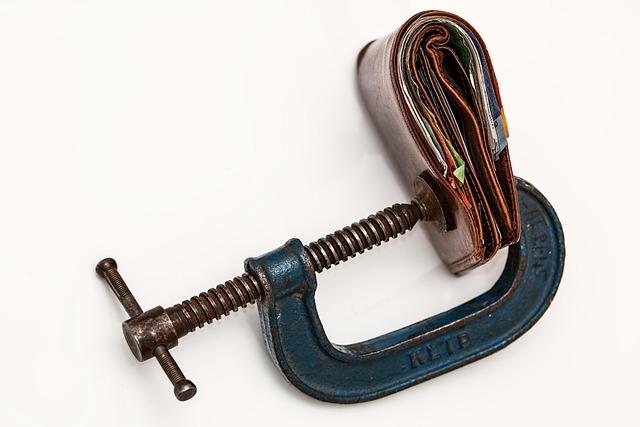

Struggling with high-interest debt? It’s time to explore smarter ways to gain financial control. This article unveils three strategic approaches using Debt Consolidation Loans as a powerful tool for managing and reducing your debt burden. By understanding the benefits of this loan type, you can make an informed decision to simplify payments and lower interest rates, ultimately unlocking your path to financial freedom. Discover how a Loan for Debt Consolidation can transform your financial landscape.

- Understanding Debt Consolidation Loans: Unlocking Financial Freedom

- The Benefits of Using a Loan for Debt Consolidation

- Strategies for Refinancing High-Interest Debt Effectively

Understanding Debt Consolidation Loans: Unlocking Financial Freedom

Debt consolidation loans offer a strategic approach to managing high-interest debt by combining multiple outstanding debts into a single loan with a potentially lower interest rate. This simplifies repayment, making it easier to stay on track and save money in the process. A loan for debt consolidation allows borrowers to reduce their monthly payments and pay off their debt faster. By focusing on one loan with manageable terms, individuals can free up financial resources, which can be redirected towards savings or other important expenses.

Understanding debt consolidation loans is crucial for those burdened by high-interest rates across multiple credit lines. This financial strategy provides an opportunity to break free from the cycle of compounding interest and gain control over their money. With careful consideration and expert guidance, consolidating debt through a loan can be a game-changer for achieving long-term financial stability and peace of mind.

The Benefits of Using a Loan for Debt Consolidation

Debt consolidation loans offer a strategic approach to managing high-interest debt by combining multiple outstanding debts into a single loan with potentially lower interest rates. This simplifies repayment by reducing the number of payments you need to make each month, easing financial strain and allowing for better budgeting. Moreover, these loans often provide more favorable terms, such as fixed interest rates, that protect against future rate fluctuations, ensuring consistent monthly payments.

By securing a loan for debt consolidation, individuals can break free from the cycle of high-interest payments and multiple creditors. This approach not only streamlines financial obligations but also paves the way for faster debt repayment. With a consolidated loan, you focus on paying off the principal balance with reduced distractions, ultimately saving money in interest charges over time.

Strategies for Refinancing High-Interest Debt Effectively

When considering how to tackle high-interest debt, one of the smartest moves you can make is to explore Debt Consolidation Loans. These specialized financial instruments are designed to simplify your repayment process by combining multiple debts into a single loan with a potentially lower interest rate. By doing so, you’ll save on the extra charges that come with multiple high-rate loans and streamline your payments into one manageable schedule. This strategy not only reduces your monthly outgoings but also helps you pay off your debt faster.

A Loan For Debt Consolidation offers more than just a lower interest rate; it provides clarity and control over your financial situation. With this approach, you’re better equipped to budget effectively as you gain a comprehensive view of your overall debt obligations. Furthermore, many consolidation loans come with flexible repayment terms tailored to your needs, ensuring you can make payments that fit your budget without the burden of high-interest charges.

Debt Consolidation Loans can be a powerful tool to manage high-interest debt. By understanding the benefits of this approach and employing effective refinancing strategies, individuals can gain financial freedom and save money in the long run. A Loan For Debt Consolidation is not just about reducing interest rates; it’s about simplifying payments and creating a clear path to paying off debts once and for all.