In today's complex financial landscape, Debt Consolidation Loans offer a strategic solution for individuals struggling with multiple debts. These specialized loans combine various outstanding debts into one manageable loan, simplifying payments and potentially reducing interest expenses. There are two main types: secured loans requiring collateral for lower rates or unsecured loans with higher rates but no collateral needed. To apply, assess your financial situation, research lenders with favorable terms, gather necessary documents, accurately complete the application, and stay proactive during the process. Debt Consolidation Loans have proven successful in helping individuals pay off high-interest credit cards, personal loans, and even student loans, leading to reduced stress, improved cash flow, and a clearer path to financial freedom.

“Taming the Beast: My High-Debt Loan Journey” delves into the world of debt consolidation loans, a powerful tool for managing overwhelming debt. Understanding the diverse landscape of Loan For Debt Consolidation options is crucial. This article guides you through evaluating various loan types, navigating the application process step-by-step, and sharing inspiring success stories of those who’ve successfully tamed high debt. By the end, you’ll be equipped to make informed decisions about a Loan For Debt Consolidation.

- Understanding the Debt Consolidation Loan Landscape

- Evaluating Your Options: Types of Loans for Debt Consolidation

- Navigating the Application Process: A Step-by-Step Guide

- Success Stories: Taming High Debt with Consolidated Loans

Understanding the Debt Consolidation Loan Landscape

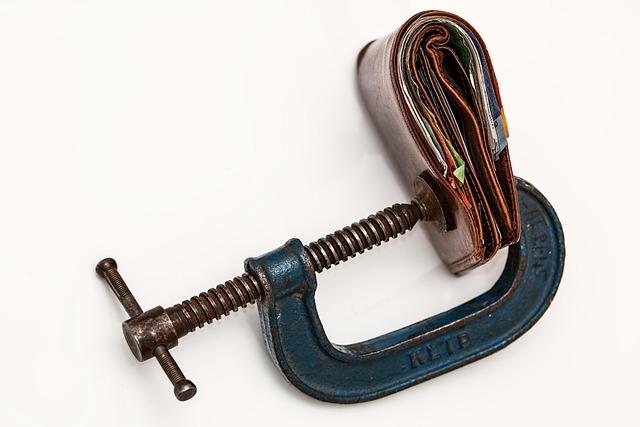

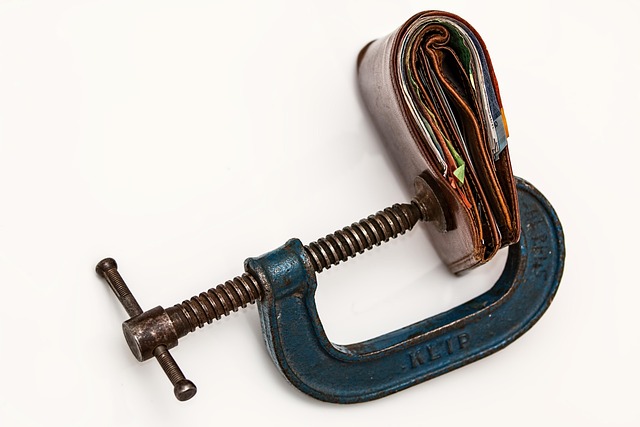

In today’s financial landscape, managing multiple debts can feel like navigating a labyrinthine maze. This is where Debt Consolidation Loans step in as a potential game-changer for many individuals burdened by high debt. These specialized loans offer a strategic approach to simplifying complex debt situations by combining several outstanding debts into one manageable loan. By doing so, borrowers can bid farewell to the hassle of multiple monthly payments and potentially reduce their overall interest expenses.

A Loan for Debt Consolidation is particularly attractive as it allows individuals to gain control over their finances. Borrowers can negotiate better terms, including lower interest rates, longer repayment periods, or both. This not only makes debt repayment more affordable but also provides psychological relief, often a crucial aspect in the process of financial recovery. With careful planning and expert guidance, taming the beast of high debt becomes an achievable goal.

Evaluating Your Options: Types of Loans for Debt Consolidation

When facing a mountain of high-interest debts, many turn to debt consolidation loans as a potential solution for financial freedom. The first step in taming this beast is understanding your options. A loan for debt consolidation serves as a single, more manageable payment that combines multiple debts into one. This strategy simplifies repayment by reducing the number of payments you have to track each month and can save money on interest charges over time.

There are several types of loans available for this purpose, including secured and unsecured options. Secured loans require collateral, typically in the form of a car or home, offering potentially lower interest rates but posing a risk if you default. Unsecured loans, while convenient with no collateral requirement, usually carry higher interest rates. Each type has its advantages and considerations, so careful evaluation is crucial to find the best fit for your financial situation.

Navigating the Application Process: A Step-by-Step Guide

Navigating the application process for a Debt Consolidation Loan can seem daunting, but with a clear, structured approach, it becomes manageable. First, assess your financial situation and calculate your total debt amount. This step is crucial as it determines the loan size needed to effectively consolidate your debts. Next, research various lenders offering Debt Consolidation Loans and compare their terms, interest rates, and repayment plans. Look for loans with lower interest rates and flexible terms to ensure long-term savings.

Once you’ve identified a suitable lender, gather necessary documents such as proof of income, employment details, and identification. These are essential for verifying your financial standing and eligibility for the loan. Complete the application form accurately and honestly, providing all required information. Be prepared to answer questions about your debt history and current financial obligations. After submitting the application, stay proactive by regularly checking the status with the lender and ensuring all necessary paperwork is in order.

Success Stories: Taming High Debt with Consolidated Loans

Many individuals struggling with high debt have found a light at the end of the tunnel through Debt Consolidation Loans. These specialized loans offer a strategic approach to managing multiple debts by combining them into a single, more manageable payment. This not only simplifies financial obligations but can also significantly reduce interest rates, allowing borrowers to pay off their debts faster and save money in the long run.

Success stories abound of those who have successfully tamed their debt beasts with Loan For Debt Consolidation. By consolidating high-interest credit card debts, personal loans, and even student loans, these individuals have regained control over their finances. They report reduced stress, improved cash flow, and a clearer path to financial freedom. This transformation is not just about numbers; it’s about reclaiming one’s financial future and securing a more stable tomorrow.

Debt consolidation can be a powerful tool for managing high debt, offering clarity and financial control. By exploring the various loan options available, understanding the application process, and learning from success stories, individuals can make informed decisions to “tame the beast” of overwhelming debt. Debt consolidation loans provide a strategic path towards financial freedom, allowing folks to focus on rebuilding their financial future.